Commercial and industrial (C&I) energy storage systems have revolutionized how businesses manage electricity costs and support electric vehicle infrastructure. These advanced lithium-ion battery solutions enable companies to store excess energy during low-demand periods and release it when needed most. C&I energy storage applications range from supporting EV charging stations to reducing peak demand charges, making them essential for modern energy management strategies. By integrating these systems, businesses can achieve significant cost savings while contributing to grid stability and renewable energy adoption.

Understanding C&I Energy Storage Applications in Modern Business

Commercial and industrial energy concerns are difficult for traditional power systems to solve. Peak demand prices can account for 30-70% of electricity bills, and electric vehicle growth strains infrastructure. Energy storage systems fill these gaps with flexible, scalable solutions that meet operational needs.

Technology for large-scale energy storage has advanced during the past decade. Modern systems can sustain 46.2KW of solar input at 1500V open-circuit voltage. Industrial facilities can seamlessly integrate renewables with huge PV arrays due to this versatility.

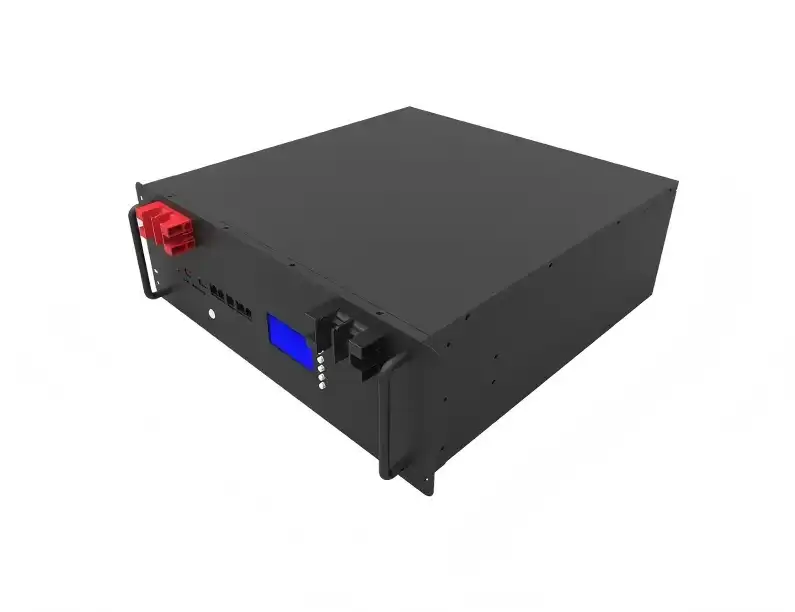

Modern battery management systems maximize performance across various applications with advanced energy management. These systems provide 32KW of AC power and have wide working ranges for commercial applications. The integrated platform solves many energy issues.

Core Application Areas for C&I Energy Storage Systems

Electric Vehicle Charging Infrastructure Support

Electricity needs from EV charging stations can overrun existing infrastructure. Level 3 fast chargers use 50–350 kW, doubling a facility's peak demand in minutes. Power spikes are mitigated by energy storage systems pre-charging during low demand and supplying electricity when vehicles connect.

Four 51.2V 314Ah lithium-ion batteries store 64.3KWh, supporting repeated charging sessions. Businesses can run high-power charging stations without costly utility infrastructure modifications. Retail, corporate, and fleet depots save money on installation and demand charges with this technique.

Multiple charging outlets can be dynamically load-balanced with a smart grid connection. When multiple vehicles charge at once, the energy management system seamlessly divides grid and battery power. This cooperation eliminates grid overburden and optimizes charging speeds for all connected vehicles.

Peak Shaving and Demand Charge Reduction

Commercial clients pay based on their highest 15-minute power use throughout billing periods. Electricity bills are generally dominated by demand charges, regardless of energy consumption. Energy storage systems monitor power usage and discharge when peaking.

Peak shaving greatly benefits heavy machinery cycle manufacturing operations. Battery systems immediately augment grid power to flatten the demand curve when industrial equipment starts up. This automated response can cut electricity expenses 20-40% without hurting productivity.

Multiple MPPT channels optimize energy harvesting from multiple sources, improving system efficiency. Six MPPT controllers with voltage ranges of 125-425V and a maximum current of 26A per channel optimize performance across solar panel layouts and environmental circumstances.

Renewable Energy Integration and Storage

Commercial solar energy production rarely matches consumption. Energy storage devices store peak solar generation and release it when demand rises or solar output drops. Time-shifting optimizes renewable energy use and reduces grid dependency.

Huge roofs allow industrial enterprises to install huge PV arrays and energy storage systems. The wide operating temperature range (-20~60℃) guarantees consistent performance in diverse environments, from cold storage warehouses to desert manufacturing sites. This versatility makes energy storage suitable for many places and uses.

Frequency regulation services boost C&I energy storage owners' revenue. To preserve grid stability, grid operators pay for technologies that swiftly change charging and discharging rates. Modern battery management systems respond to frequency signals in seconds, improving grid health and earning extra money.

Backup Power and Grid Resilience

Industrial facilities lose millions annually due to power outages, spoiled inventory, and equipment damage. Energy storage devices keep key operations running during grid outages until generators start or utility service resumes. Battery systems start quickly without fuel or delays, unlike generators.

Server operations and cooling systems depend on consistent power in data centers. Energy storage prevents costly downtime and data loss between grid breakdown and generator restart. For emergencies, hospitals use similar arrangements to sustain life-support equipment and key medical systems.

Modular architecture lets facilities expand backup capacity as needed. Critical loads may receive full backup duration, while less critical systems operate on reduced power during outages. While retaining vital functions, this selected strategy optimizes battery capacity allocation.

Energy Arbitrage and Time-of-Use Optimization

Peak electricity prices are 2-4 times higher than off-peak rates. Energy arbitrage involves charging batteries during low-cost periods and discharging during busy hours. This method reduces electricity purchases, saving money.

Retailers with steady daytime loads benefit greatly from time-of-use optimization. Batteries charge overnight at modest rates and discharge during expensive midday air cooling loads. Warehouse operations can move energy-intensive tasks to low-cost periods while retaining productivity.

Automatic charging schedule optimization is possible with advanced energy management systems that predict facility load patterns and power cost. Machine learning algorithms update optimization to seasonal and operational changes without operator intervention.

Grid Services and Ancillary Revenue Generation

Utility companies need grid support services to preserve power quality and stability. C&I energy storage systems can generate revenue while providing these services. Voltage regulation, spinning reserves, and black start capabilities offer commercial prospects for equipped systems.

Demand response programs pay facilities for reducing use under grid stress. Energy storage ensures participation without disruption by supplying stored electricity when grid demand rises. This capability makes production interruptions profitable.

Scalability lets systems adapt to changing grid service needs. Software updates and modest hardware upgrades can upgrade current installations as rules change and new market opportunities arise.

Electric Fleet Charging Management

Commercial fleets switching to electric vehicles confront charging issues. Multiple vehicles returning at once might strain the electrical infrastructure and cause high demand charges. Energy storage systems pre-charge during the day and supply power during peak charging.

Intelligent charging coordination helps delivery businesses with predictable routes. Energy management systems optimize grid and battery power distribution to reduce costs and charge all vehicles by learning vehicle return patterns. Night-time charging uses low electricity rates to cut costs.

Electric bus fleets are managed similarly by public transit. Large battery installations allow quick recharge during short layovers without grid infrastructure modifications. This allows existing routes to be electrified without utility coordination or construction delays.

Technical Advantages of Modern C&I Energy Storage

Contemporary energy storage systems offer remarkable technical capabilities that enable diverse applications across commercial and industrial settings. High inverter power ratings support substantial loads while maintaining broad voltage compatibility for various facility requirements. AC output capabilities reaching 32KW with 220VAC/230VAC operation ensure compatibility with standard commercial electrical systems.

Efficient MPPT operation maximizes energy harvesting from renewable sources while minimizing losses. Advanced power conversion technology maintains high efficiency across varying load conditions and environmental factors. These improvements translate directly into improved return on investment through enhanced energy capture and utilization.

Thermal management systems maintain optimal battery performance across wide temperature ranges. Active cooling and heating ensure consistent operation in challenging environments, from refrigerated warehouses to outdoor installations. This reliability reduces maintenance requirements and extends system lifespan significantly.

Implementation Considerations for C&I Applications

Analyzing facility energy patterns, utility rate structures, and operational needs is essential for energy storage adoption. Load profiling indicates peak demand and savings opportunities, while site studies optimize equipment location and electrical connections. Effective system sizing and setup start with professional energy audits.

Installation requirements and incentives vary widely due to regulatory compliance. Before starting a project, understand local building codes, electrical standards, and utility connecting processes. Expert integrators familiar with area regulations provide smooth deployment and regulatory approval.

Finance possibilities include direct purchase, leasing, and power purchase agreements without upfront capital. Each option has advantages based on facility ownership, tax situation, and cash flow preferences. Properly organized government incentives and utility rebate programs can boost project economics.

Economic Benefits and Return on Investment

Savings from demand charge reduction, energy arbitrage, and ancillary services let energy storage investments pay for themselves in 3-7 years. Manufacturing facilities have the shortest payback periods because of high demand and consistent load patterns. Consistent daily cycles maximize time-of-use savings in retail.

Beyond electricity savings, cost efficiency reduces infrastructure upgrades and increases operational flexibility. Facilities contemplating electrical system expansions can avoid costly utility improvements by adding energy storage. This method offers immediate benefits and preserves expansion options.

For 15-20 years, the cycle life criteria of 6,000 cycles preserve value. Lithium-ion batteries with high performance last longer and provide reliable returns. Warranty and performance assurances safeguard investments.

Future Outlook for C&I Energy Storage Markets

The commercial and industrial energy storage sector is growing quickly as battery costs drop and performance improves. Due to rising electricity costs, system upgrades, and business sustainability, researchers predict a 25-30% yearly increase through 2030. Early adopters can gain competitive benefits from this increase.

Demand for energy storage infrastructure will rise as electric vehicle adoption accelerates. Corporate fleets, public transportation, and commercial charging networks need advanced energy management. Storage investments currently position facilities for future electrification.

Through improved grid service participation, smart grid development creates new revenue prospects. Vehicle-to-grid, dynamic pricing, and automated demand response will increase the value to energy storage owners. Systems installed today can typically be upgraded to enable new capabilities.

Conclusion

C&I energy storage systems revolutionize modern commercial and industrial facilities to optimize energy costs and operational resilience. These flexible solutions solve energy problems with integrated platforms, from EV charging infrastructure to peak demand pricing. Downward battery costs, improved performance, and expanded grid service options provide forward-thinking enterprises with appealing investment opportunities. Energy storage systems will become vital for competitive operations in all commercial and industrial sectors as electric vehicle adoption and grid upgrading increase.

FAQ

Q: What is the typical lifespan of a C&I energy storage system?

A: Modern lithium-ion C&I energy storage systems typically last 15-20 years with proper maintenance. High-quality systems maintain 80% of their original capacity after 6,000+ charge cycles, ensuring long-term performance and return on investment for commercial applications.

Q: How quickly can an energy storage system pay for itself?

A: Payback periods typically range from 3-7 years, depending on facility energy patterns, local utility rates, and available incentives. Facilities with high demand charges and predictable load profiles often achieve the fastest returns through peak shaving and demand charge reduction.

Q: Can energy storage systems work with existing solar installations?

A: Yes, energy storage systems integrate seamlessly with existing solar PV systems. Modern storage solutions support up to 46.2KW of solar input with voltage compatibility up to 1500V, enabling retrofitting of established solar installations to capture and store excess generation.

Partner with TOPAK for Your C&I Energy Storage Solutions

TOPAK New Energy Technology delivers comprehensive c&i energy storage solutions backed by over 17 years of industry experience since our founding in 2007. Our 25,000-square-foot㎡ manufacturing facility in Shenzhen operates large-scale automated production lines that ensure consistent quality and rapid delivery for projects worldwide. As a trusted C&I energy storage manufacturer, we provide fully customized battery packs with in-house BMS technology designed specifically for commercial and industrial applications. Ready to reduce your energy costs and enhance grid resilience? Contact us at B2B@topakpower.com to discuss your energy storage requirements.

References

1. International Energy Agency. "Grid-Scale Storage and the Energy Transition." IEA Technology Roadmap, 2023.

2. McKinsey & Company. "Commercial and Industrial Energy Storage: Market Analysis and Growth Projections." Energy Insights Report, 2023.

3. U.S. Department of Energy. "Energy Storage for Commercial Buildings: Applications and Economic Analysis." Office of Energy Efficiency and Renewable Energy, 2023.

4. Bloomberg New Energy Finance. "Commercial Energy Storage Deployment Trends and Market Opportunities." BNEF Research, 2023.

5. National Renewable Energy Laboratory. "Electric Vehicle Charging Infrastructure and Energy Storage Integration Study." NREL Technical Report, 2023.

6. Rocky Mountain Institute. "Peak Demand Management Through Energy Storage: Commercial and Industrial Applications." RMI Analysis, 2023.