The global 51.2V 100Ah vertical battery market is experiencing unprecedented growth as industries shift toward sustainable energy solutions. Current market analysis indicates that 51.2V 100Ah vertical battery systems range from $800 to $1,500 per unit globally, with significant variations based on manufacturing origin, certification levels, and bulk order quantities. Understanding these pricing dynamics becomes crucial for industrial equipment manufacturers, energy storage integrators, and OEMs planning their 2026 procurement strategies.

Global Market Dynamics for Vertical Battery Systems

In the past year, the energy storage business has changed in amazing ways. High-capacity lithium-ion battery solutions are still in high demand in the telecommunications, green energy storage, and industrial automation markets. As the technology for deep cycle batteries gets better, costs go down, and performance goes up.

Regional Manufacturing Hubs

Asia-Pacific makes most of the world's batteries, including products such as the 51.2V 100Ah Vertical Battery, with about 75% of the world's vertical mount battery manufacturing capacity. Guangdong province in China, industrial zones in South Korea, and advanced technology areas in Japan are some of the world's most important places for making things. European factories focus on high-end markets, while North American factories mostly work on specific tasks.

Supply Chain Developments

The supply of raw materials has a big effect on how prices are set. Prices for lithium carbonate leveled off after being unstable in 2023, but markets for nickel and cobalt are still affected by political issues. Automated production lines make factories more efficient and make sure that quality standards are the same across all of them.

Comprehensive Price Analysis and Market Breakdown

Procurement professionals can make better choices when they understand complex pricing structures. The prices that factories set now are based on complicated cost estimates that take into account things like raw materials, production methods, quality control measures, and legal requirements.

Factory Price Ranges (FOB/CIF)

A recent study of the market shows that 51.2V 100Ah systems made in Asia cost between $700 and $1,200 FOB. High-end European goods cost between $1,100 and $1,800 per unit CIF big ports. These differences are due to different levels of quality, certification, and the level of complexity of the integrated battery management system.

Competitive options from mid-level manufacturers range from $850 to $1,100 per unit, balancing low costs with reliable performance. High-end systems with improved safety features and batteries that last longer are worth the extra money because they have more energy per unit area and come with full warranty coverage.

Minimum Order Quantities and Bulk Pricing

For standard configurations, most makers set MOQs at 50 to 200 units. Bulk prices usually start at orders of 100 units or more and offer savings of 5 to 8 percent. If you buy more than 500 units, you can usually get 12–15% off, and if you sign an annual deal, you can save another 3–5%.

Custom battery pack configurations may need higher MOQs because they need special tests and tooling. Smaller amounts can be used for prototype development and market testing, though, if the manufacturer is well-known and has flexible production options.

Additional Cost Considerations

Tariffs on imports range a lot from one country to another. For example, the 51.2V 100Ah Vertical Battery, like other goods, may face US product tariffs ranging from 7.5% to 25 percent depending on the type of goods and their origin. Tariffs on European markets are usually between 6 and 10 percent, but many developing markets offer better rates for equipment that stores green energy.

Shipping by sea costs between $45 and $85 per unit, while shipping by air costs between $120 and $180 per unit. Customs clearance, handling fees, and paperwork usually add $25 to $50 to each package, no matter how much is being sent.

Critical Factors Influencing Pricing Structures

Aside from basic manufacturing prices, there are other factors that affect the final price. Understanding these factors helps buying teams negotiate better with suppliers and make more accurate budget plans.

Raw Material Cost Fluctuations

After going up and down a lot in 2023, lithium prices settled around $15,000 to $18,000 per ton. Nickel markets are still affected by Indonesia's export rules and problems with Russia's supplies. The price of cobalt stays pretty stable because of different ways to get it and recycling schemes.

Quality of battery cells is directly related to how pure the raw materials are and how they are processed. Premium battery makers put money into certified supply chains to make sure consistent performance and longer guarantee coverage.

Labor and Manufacturing Efficiency

Automated production lines make quality more consistent while reducing the need for workers. Leading producers automate more than 95% of the most important parts of the assembly process. This investment in technology raises capital costs at first, but it will lower prices and improve quality in the long run.

Technicians with the right skills are still needed for quality control, testing, and making unique configurations. Investing in training and offering reasonable pay packages affects the overall cost of making a product and how reliable it is.

Exchange Rate Impacts

Changes in currencies have a big effect on prices between countries. When the USD gets stronger against Asian currencies, the cost of imports can drop by 5–12 percent every three months. Currency hedging is often a part of long-term contracts to protect both buyers and sellers from extreme price changes.

Regional Price Comparison Analysis

The place where a product is made has a big effect on its prices, quality standards, and transportation options. A full comparison shows that different production regions have clear benefits.

Asia-Pacific Manufacturing

Chinese makers offer very low prices and have put a lot of money into automating their production processes. Since a few years ago, quality has gotten better at many facilities, making them the first choice for big international brands. Most standard setups take between 15 and 25 business days to deliver.

South Korean facilities focus on high-end markets with improved safety features and higher energy densities for batteries. These goods cost 15–25% more than similar ones, but they work very well in demanding situations like battery systems for electric vehicles and installations that need to backup power.

European Production Advantages

European makers put a lot of emphasis on being environmentally friendly, recycling in advanced ways, and being sustainable. Even though these facilities still cost 20–35% more than Asian options, they have benefits for customers in the EU, such as lower shipping costs, faster delivery, and easier compliance with regulations.

German and Swedish facilities are especially good at industrial-grade tasks that need to be very reliable and have a lot of technical help. A lot of the time, their goods have custom battery management systems that are made to work best in certain situations.

North American Market Dynamics

Due to government incentives and reshoring programs, the US continues to increase its manufacturing capacity. When goods are made in the country where they are sold, tax worries go away, and supply chains get shorter. But because of current capacity limits, prices are still 25–40% higher than imported options.

Strategic Procurement Optimization

To be good at procurement, you need to know what the seller can do, how to negotiate, and when the market is likely to open, whether you are sourcing general products or specialized items like the 51.2V 100Ah Vertical Battery. Smart buyers use more than one method to get the best prices and make sure that supply lines are reliable.

Supplier Negotiation Strategies

Having long-term ties with more than one supplier gives you more negotiating power and supply security. A lot of the time, annual volume agreements let you get better prices and faster production during times of high demand.

Opportunities for technical teamwork can lower costs by making designs better and manufacturing more efficiently. Customers who give clear specifications and reasonable wait times for custom configurations are appreciated by suppliers.

OEM/ODM Customization Benefits

Custom battery pack setups can lower the total cost of the system by getting rid of features that aren't needed while still making it work better for certain tasks. Most of the time, rechargeable battery systems that are made for specific uses are more cost-effective than generic goods.

Suppliers can offer cheaper options through collaborative design processes that don't affect important performance requirements. A lot of the time, these relationships lead to new ideas that help both sides.

Market Forecast and Pricing Trends

Analysts in the industry think that prices will stay the same until 2026, with only small rises to account for better technology and safety features. As the market matures and the industry scales up, the cost of raw materials should go down.

Technology Development Impact

New battery cell technologies offer more energy per unit of weight and longer life. At first, adoption may require higher prices, but by late 2025, mass production should reach cost parity with current options.

Better connection with battery chargers and faster battery discharge rates increase value without having a big effect on the cost of production. These improvements help manufacturers who spend money on research and development get a better place in the market.

Supply Chain Evolution

Regional supply chain growth makes deliveries more reliable and less reliant on a single source of suppliers. Distributed manufacturing helps keep prices stable even when there are problems in one area or when there are political issues in another.

Leading manufacturers that use vertical integration methods can save money and keep quality high throughout the whole production process. These investments help keep prices low and keep customers happy over the long run.

Conclusion

The 51.2V 100Ah vertical battery market demonstrates remarkable stability despite ongoing global economic uncertainties. Current pricing ranges from $750-$1,800 per unit, depending on quality tier, certification requirements, and supplier capabilities. Smart procurement strategies focusing on supplier relationships, volume commitments, and technical collaboration deliver optimal value propositions. Market outlook remains positive through 2026, with technology improvements and manufacturing efficiency gains supporting continued price stability. Industrial buyers should prioritize supplier reliability, comprehensive technical support, and proven track records over purely cost-based decisions. Strategic partnerships with established manufacturers ensure long-term success while minimizing supply chain risks and total cost of ownership.

FAQ

Q: What factors most significantly impact 51.2V 100Ah vertical battery pricing?

A: Raw material costs, manufacturing automation levels, certification requirements, and order quantities represent primary pricing factors. Quality tier selection and supplier location also substantially influence final costs. Currency exchange rates and shipping methods contribute additional variability to total landed costs.

Q: How do MOQ requirements affect pricing for small to medium orders?

A: Most manufacturers establish 50-200 unit MOQs for standard products. Smaller quantities often incur 10-15% price premiums, while orders below MOQ may require custom quotations. Building relationships with suppliers can sometimes reduce these requirements for qualified customers.

Q: What certification requirements should buyers prioritize for international markets?

A: Essential certifications include IEC62619, UN38.3, and UL listings for most global markets. MSDS documentation ensures safe shipping and handling. Regional requirements like CE marking for Europe or FCC compliance for North America may apply depending on specific applications and target markets.

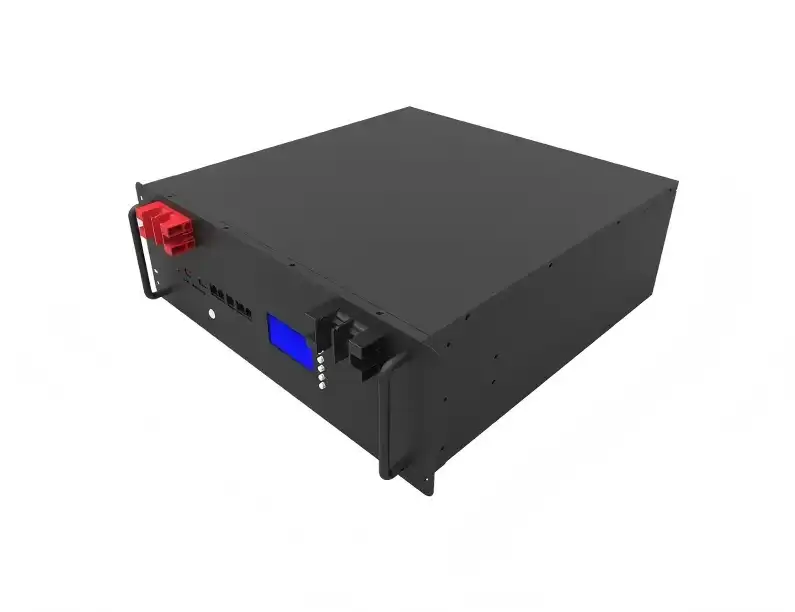

Partner with TOPAK for Premium 51.2V 100Ah Vertical Battery Solutions

TOPAK New Energy Technology delivers exceptional value through our comprehensive 51.2V 100Ah vertical battery manufacturing expertise. Since 2007, our proven track record has served industrial equipment manufacturers, energy storage integrators, and OEM customers worldwide. Our TP-48100V model combines superior cycle life exceeding 6000 cycles with compact vertical design optimization, providing 5.12 kWh energy density in space-efficient configurations.

Our in-house developed battery management system ensures optimal safety and performance, while automated production lines guarantee consistent quality and competitive pricing. With global distribution capabilities spanning 15+ countries and comprehensive technical support, TOPAK serves as your trusted 51.2V 100Ah vertical battery supplier for long-term partnerships. Experience our advanced lithium-ion technology, flexible customization options, and reliable delivery performance. Contact us at B2B@topakpower.com to discuss your specific requirements and secure competitive quotations for your next project.

References

1. International Energy Agency. "Global Energy Storage Market Analysis and Forecast 2024-2026." IEA Publications, 2024.

2. Bloomberg New Energy Finance. "Lithium-Ion Battery Pack Prices Survey 2024." BNEF Research, 2024.

3. Wood Mackenzie. "Energy Storage Cost and Performance Database 2024." WoodMac Power & Renewables, 2024.

4. IDTechEx. "Li-ion Battery Market Analysis: Materials, Applications and Prices 2024-2034." IDTechEx Research, 2024.

5. Navigant Research. "Industrial Energy Storage Systems: Market Analysis and Forecasts." Guidehouse Insights, 2024.

6. Frost & Sullivan. "Global Battery Management System Market Analysis and Growth Opportunities 2024-2030." Frost & Sullivan Research, 2024.