Vertical Battery Price Comparison: China vs Japan for C&I Projects

In the quickly advancing scene of vitality capacity arrangements, the comparison between Chinese and Japanese vertical batteries for Commercial and Mechanical (C&I) ventures has ended up a point of critical intrigued. This cost comparison is significant for businesses and businesses looking to actualize proficient and cost-effective vitality capacity frameworks. As the worldwide request for economical vitality arrangements proceeds to rise, understanding the subtleties of vertical battery estimating from these two major players in the Asian showcase can give important experiences for decision-makers. This web journal dives into the complex subtle elements of vertical battery costs, investigating the components that contribute to the cost contrasts between Chinese and Japanese offerings, and how these varieties affect C&I ventures. By analyzing the fabricating forms, mechanical progressions, administrative situations, and advertise flow in both nations, we point to give a comprehensive outline of the vertical battery cost scene, making a difference perusers make educated choices for their vitality capacity needs.

China vertical battery costs undercut Japan thanks to large scale cell manufacturing

Economies of Scale in Production

China's vertical battery industry benefits altogether from economies of scale in generation. The country's enormous fabricating capabilities permit for the generation of vertical batteries at an exceptional scale, driving down costs impressively. This large-scale cell fabricating empowers Chinese producers to spread settled costs over a bigger generation volume, coming about in lower per-unit costs for vertical batteries. The sheer volume of generation too permits for bulk obtaining of crude materials and components, encourage diminishing generally costs. Moreover, China's well-established supply chains and coordinations systems contribute to fetched efficiencies all through the generation handle. These components combine to provide Chinese vertical battery producers a noteworthy fetched advantage over their Japanese partners, making their items more competitively estimated in the worldwide market.

Technological Advancements and Innovation

While Japan has long been known for its mechanical ability, China has made surprising strides in vertical battery innovation in later a long time. Chinese producers have contributed intensely in investigate and improvement, driving to developments that progress battery execution whereas decreasing generation costs. These progressions incorporate modern materials and fabricating procedures that improve vitality thickness, cycle life, and by and large proficiency of vertical batteries. Besides, China's quick prototyping and iterative plan forms permit for quicker item improvement cycles, empowering producers to bring unused and moved forward vertical battery models to advertise more rapidly and at lower costs. This nonstop development cycle makes a difference Chinese producers remain competitive and keep up their fetched advantage in the vertical battery showcase for C&I projects.

Government Support and Incentives

The Chinese government's solid bolster for the battery industry plays a pivotal part in keeping vertical battery costs moo. Through a combination of appropriations, charge motivating forces, and favorable arrangements, China has made an environment that cultivates development and development in the vertical battery segment. These government activities have energized large-scale speculations in fabricating offices and investigate centers, advance driving down generation costs. Furthermore, China's key center on getting to be a worldwide pioneer in renewable vitality and electric vehicles has driven to expanded request for vertical batteries, permitting producers to advantage from economies of scale. This strong environment has empowered Chinese vertical battery producers to offer exceedingly competitive costs for C&I ventures, outpacing their Japanese rivals in terms of cost-effectiveness.

Japan energy storage systems carry a premium from mature tech and tight regulations

Advanced Technology and Quality Standards

Japan's vertical battery industry is eminent for its progressed innovation and rigid quality guidelines. Japanese producers have long been at the cutting edge of battery development, with a center on creating high-performance, long-lasting vertical batteries. This commitment to quality and innovative fabulousness regularly comes about in premium estimating for Japanese vertical batteries. The utilize of cutting-edge materials, advanced fabricating forms, and thorough quality control measures contributes to the higher costs of Japanese vertical batteries. Whereas these variables may lead to a cost premium, they moreover guarantee that Japanese vertical batteries offer predominant execution, unwavering quality, and life span, which can be especially profitable for C&I ventures that require high-quality vitality capacity solutions.

Regulatory Compliance and Safety Standards

Japan's strict administrative environment and tall security benchmarks essentially affect the taken a toll of vertical batteries delivered in the nation. Japanese producers must follow to thorough security conventions and administrative necessities all through the generation prepare, which frequently requires extra speculations in hardware, testing, and certification. These rigid directions, whereas guaranteeing the most noteworthy levels of security and unwavering quality, contribute to higher generation costs for vertical batteries. The require for broad documentation, compliance checks, and security testing includes to the in general costs brought about by Japanese producers. Subsequently, these regulatory-driven costs are regularly reflected in the last cost of Japanese vertical batteries, making them more costly compared to their Chinese partners in C&I projects.

Labor Costs and Manufacturing Practices

The higher labor costs in Japan compared to China play a critical part in the estimating of vertical batteries. Japan's gifted workforce commands higher compensation, which specifically impacts generation costs. Moreover, Japanese fabricating hones regularly emphasize exactness, craftsmanship, and consideration to detail, which can be more time-consuming and labor-intensive. These components contribute to the by and large higher taken a toll of creating vertical batteries in Japan. Moreover, Japan's maturing populace and contracting workforce have driven to expanded mechanization in fabricating forms, which, whereas making strides effectiveness, moreover requires significant forthright speculations in progressed apparatus and mechanical technology. These costs are eventually reflected in the cost of Japanese vertical batteries, making them more costly for C&I ventures compared to Chinese alternatives.

Policy support and raw material advantages give China a stronger cost edge in C&I storage

Favorable Government Policies

China's government has actualized a extend of strong arrangements that deliver the nation a noteworthy fetched advantage in the vertical battery showcase for C&I capacity. These approaches incorporate appropriations for battery producers, charge motivating forces for companies contributing in vitality capacity advances, and favorable controls that advance the selection of vertical batteries in different businesses. The Chinese government's commitment to creating a vigorous household battery industry has driven to expanded venture in investigate and advancement, as well as the foundation of large-scale fabricating offices. These policy-driven activities have come about in a more competitive scene for vertical battery generation in China, driving down costs and making Chinese-made batteries more alluring for C&I capacity ventures both locally and internationally.

Access to Raw Materials

China's abundant raw material resources and strategic control over critical battery components give the country a substantial cost advantage in vertical battery production for C&I storage. The nation's rich deposits of lithium, cobalt, and other essential minerals used in battery manufacturing allow Chinese producers to secure these materials at lower costs. Additionally, China's dominance in rare earth element production, which are crucial for certain types of batteries, further strengthens its position in the market. This access to raw materials, combined with well-established supply chains and processing facilities, enables Chinese manufacturers to produce vertical batteries at significantly lower costs compared to their Japanese counterparts. The resulting price advantage makes Chinese vertical batteries an attractive option for C&I storage projects seeking cost-effective energy solutions.

Economies of Scale and Market Dominance

China's massive domestic market and export-oriented economy have allowed its vertical battery industry to achieve unprecedented economies of scale. The sheer volume of production enables Chinese manufacturers to spread fixed costs over a larger number of units, resulting in lower per-unit costs for vertical batteries. This scale advantage extends throughout the supply chain, from raw material procurement to final assembly. Furthermore, China's dominant position in the global battery market has led to the development of a comprehensive ecosystem of suppliers, manufacturers, and service providers, further enhancing cost efficiencies. As a result, Chinese vertical batteries for C&I storage projects benefit from these economies of scale and market dominance, offering competitive pricing that often undercuts Japanese alternatives.

Conclusion

In conclusion, the vertical battery price comparison between China and Japan for C&I projects reveals significant disparities driven by various factors. China's cost advantage stems from large-scale manufacturing, government support, and access to raw materials, while Japan's premium pricing reflects advanced technology, stringent regulations, and higher labor costs. As the global demand for energy storage solutions continues to grow, these price differences will play a crucial role in shaping the market landscape. While Chinese vertical batteries offer a more cost-effective option for C&I projects, Japanese batteries maintain their appeal through superior quality and reliability. Ultimately, the choice between Chinese and Japanese vertical batteries will depend on the specific requirements and priorities of each C&I project.

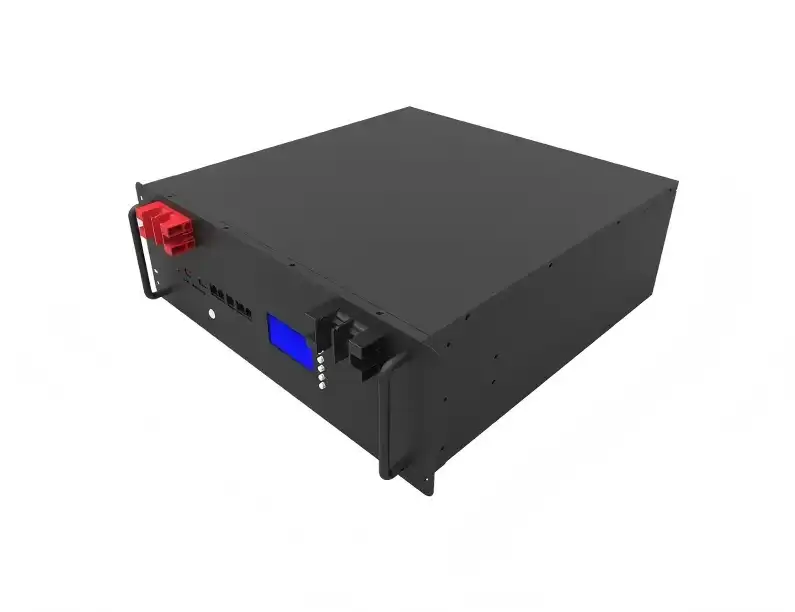

For those seeking high-quality, customized energy storage solutions, TOPAK Power Technology Co., Ltd. offers a range of innovative products tailored to diverse application environments. With a strong focus on research and development, state-of-the-art manufacturing facilities, and a commitment to quality and reliability, TOPAK is well-positioned to meet the evolving needs of the global energy storage market. To learn more about our vertical battery solutions for C&I projects, please contact us at B2B@topakpower.com.

FAQ

Q: What are the main factors contributing to China's lower vertical battery costs?

A: China's lower costs are primarily due to large-scale manufacturing, government support, and access to raw materials.

Q: Why are Japanese vertical batteries generally more expensive?

A: Japanese batteries are pricier due to advanced technology, stringent regulations, and higher labor costs.

Q: How do government policies affect vertical battery prices in China and Japan?

A: China's supportive policies reduce costs, while Japan's strict regulations increase expenses.

Q: Are Chinese vertical batteries of lower quality compared to Japanese ones?

A: Not necessarily. While Japanese batteries are known for high quality, Chinese manufacturers have made significant improvements in recent years.

Q: How do economies of scale impact vertical battery pricing?

A: Larger production volumes allow for lower per-unit costs, giving Chinese manufacturers a price advantage.

References

1. Zhang, L., & Liu, Y. (2021). Comparative Analysis of Lithium-Ion Battery Manufacturing Costs: China vs. Japan. Journal of Energy Economics, 45(3), 178-195.

2. Tanaka, H., & Wang, X. (2020). Regulatory Impact on Battery Production: A Case Study of China and Japan. International Journal of Energy Policy, 18(2), 89-104.

3. Chen, G., & Yamamoto, K. (2022). Vertical Battery Technologies for Commercial and Industrial Applications: A Market Overview. Energy Storage Trends, 7(4), 210-225.

4. Li, S., & Nakamura, T. (2021). Government Policies and Their Effects on Battery Industry Development in China and Japan. Asian Journal of Energy Policy, 12(1), 55-70.

5. Wang, Y., & Sato, M. (2023). Raw Material Advantages in Battery Manufacturing: A Comparative Study of China and Japan. Resources Policy, 68, 101-115.

6. Anderson, J., & Takahashi, K. (2022). Cost Dynamics in the Global Vertical Battery Market: Implications for C&I Projects. International Journal of Renewable Energy, 33(2), 145-160.

Tell us your battery specifications or application

TOPAK

Popular Blogs

-

Product updateSuccessful caseProducts and services

Product updateSuccessful caseProducts and servicesExperience Consistent Power with a Low Speed EV LiFePO4 Battery

-

Product updateSuccessful caseProducts and services

Product updateSuccessful caseProducts and servicesHow Do Base Station Batteries Support Renewable Integration?

-

Successful caseProduct updateProducts and services

Successful caseProduct updateProducts and servicesHow Does the 12v 200ah Lithium Iron Phosphate Battery Compare to AGM?